Publishing checklist

- Scan competitor coverage and trends from the past 7–14 days.

- Define the audience and the pain: escalating agent spend without visibility.

- Confirm topic fit with our categories and recent posts.

- Do SEO pass: primary + secondary keywords and SERP gaps.

- Ship a 30/60/90‑day Agent FinOps playbook with links and examples.

Agent FinOps for 2026: Budget, Meter, and Charge Back AI Agents with FOCUS + OpenTelemetry

Who this is for: startup founders, e‑commerce operators, and product leaders rolling out AI agents across support, marketing, ops, and engineering — and now being asked by finance to prove control and ROI.

Why this matters now

Enterprises are moving from pilots to fleets of agents. Microsoft announced Agent 365 to help companies manage bot “workforces.” Salesforce is pushing Agentforce 360. OpenAI shipped AgentKit for building and shipping agents faster. New security vendors like Runlayer target MCP‑era agent risks. And the A2A protocol is emerging for cross‑vendor agent coordination. Together, these shifts make agent cost governance a board‑level topic, not a side project. Wired on Agent 365, TechCrunch on Agentforce 360, TechCrunch on AgentKit, TechCrunch on Runlayer, TechCrunch on A2A.

On the cost side, the FinOps Foundation’s FOCUS standard is expanding, and CFO outlets are telling finance leaders to prioritize AI‑driven cost analytics. Google Cloud reports material ROI from agentic automation — but only when it’s instrumented and governed. FinOps Foundation, CFO Dive, Google Cloud ROI.

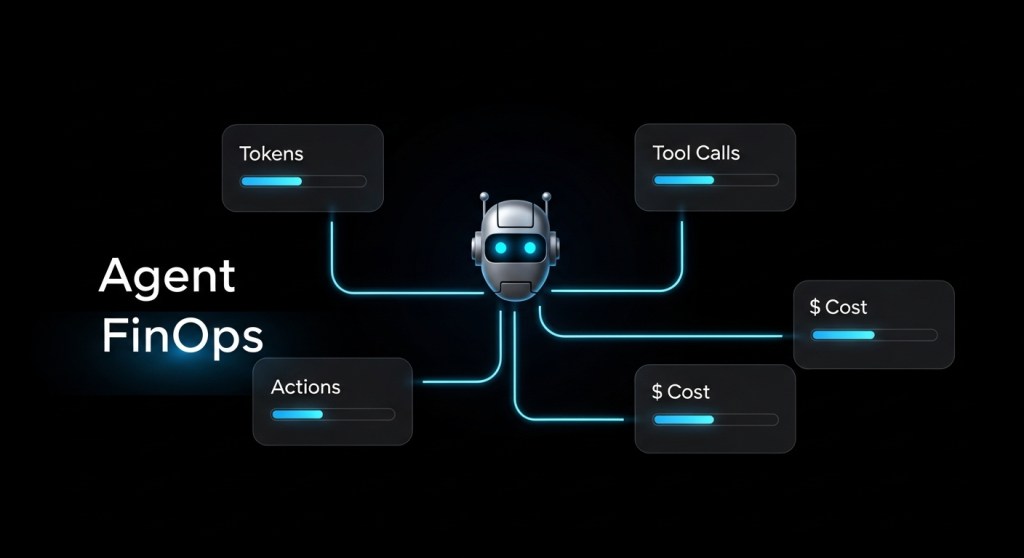

The Agent FinOps model (in plain English)

Goal: make every agent’s cost and value legible to finance and product — so you can scale the winners and cap the rest.

- Identity: every agent must have a unique, stable ID bound to an owner (team), use case, environment, and permissions. If you’re adopting MCP, make the MCP registry your source of truth.

- Metering: track tokens, tool calls, function executions, external API costs, and business actions (orders placed, tickets resolved). Emit all of this via OpenTelemetry with consistent attributes.

- Allocation: export cloud and platform bills in FOCUS format, then join them with agent telemetry to get a unified view by agent, BU, and project.

- Controls: budgets, hard ceilings, time‑of‑day policies, safe fallbacks, human escalation on anomaly.

- Chargeback/Showback: monthly reports by BU/use case with cost, value, and net margin per agent.

What to measure

- Unit costs: cost per 1,000 tokens; cost per tool call; cost per external API call; cost per agent‑minute (background agents).

- Outcome costs: cost per resolved ticket, per qualified lead, per return processed, per SKU update, etc.

- Reliability: success rate, escalation rate, mean time to recovery (MTTR), and rollback frequency.

- Efficiency: average steps per task; cache hit rate; small‑model vs large‑model mix; parallelization vs retries.

Reference architecture: FOCUS + OpenTelemetry + A2A

- Agent registry: define

agent.id, owner, environment, scopes (MCP), and allowed actions. - OTel traces: every agent step emits spans with attributes like:

{ "agent.id": "support-returns-v3", "agent.team": "cx", "agent.use_case": "returns-automation", "agent.env": "prod", "agent.session_id": "a7f...", "llm.tokens.input": 1824, "llm.tokens.output": 456, "tool.name": "shopify.refundOrder", "tool.cost_usd": 0.002, "a2a.correlation_id": "b3c...", "user.tenant_id": "shop-4421", "business.event": "return_refunded", "business.value_usd": 0 } - Billing export: pull cloud/platform usage in FOCUS and normalize into your warehouse.

- Join + allocate: match

agent.idanda2a.correlation_idacross telemetry and FOCUS tables; allocate shared costs by steps, tokens, or time. - Dashboards + controls: budgets by team/use case; anomaly detection; auto‑throttle policies; push alerts to Slack/Teams.

30/60/90‑day Agent FinOps rollout

Days 0–30: Instrument and cap risk

- Assign Agent IDs and owners. Register agents (MCP) and set least‑privilege permissions.

- Emit OpenTelemetry spans for LLM calls, tool calls, and business events. Add a cost attribution span for each external API.

- Stand up a FOCUS billing export and create the first unified spend table joined on

agent.id. - Set budgets + ceilings per agent; add a kill‑switch and escalation routing.

- Harden your baseline: see our 30‑Day Agent Security Baseline.

Days 31–60: Prove showback and value

- Publish a monthly showback by BU/use case with: cost, outcomes, net margin, and trend deltas.

- Make cost per outcome the north star (e.g., cost per solved ticket).

- Add policy automation: throttle long contexts, enforce small‑model defaults, cache embeddings, and restrict high‑cost tools after hours.

- Close the loop with revenue: implement our Agent Attribution playbook so finance sees both sides.

Days 61–90: Optimize and scale

- Adopt A/B agents: run small reasoning agents first; elevate to large models only on failure.

- Use A2A to outsource subtasks to cheaper/specialized agents; prefer short‑context tools.

- Introduce tiered SLAs (gold/silver/bronze) mapped to model sizes and concurrency.

- Portfolio review: expand winners; sunset or re‑scope bottom quartile agents.

Example: e‑commerce returns agent

A Shopify returns agent processes 2,000 requests/month.

- Before: $0.20/request (8K input + 2K output tokens on a large model) → $400/month, 83% auto‑resolve.

- After (60 days): route 70% to a small model + cache; large model only on edge cases. Cost drops to $0.07/request, auto‑resolve rises to 87%. Net: ~$140/month (‑65%) with higher CSAT. Joined FOCUS + OTel shows most savings from token cuts and fewer retries.

Top pitfalls (and quick fixes)

- No stable identity: if sessions stand in for

agent.id, you can’t allocate costs. Fix: create a global Agent Registry. - Only token metrics: tools and external APIs often dominate cost. Fix: emit

tool.cost_usdandapi.providerin spans. - Unlimited contexts: long memory chains explode spend. Fix: sliding‑window summaries; cap context tokens per step.

- No outcome ledger: cost without value is noise. Fix: attach

business.eventspans for each resolved outcome. - One‑size models: always‑large models are tax. Fix: two‑tier model strategy and strict fallbacks.

How this fits your 2026 stack

Platform leaders are converging on agent management (Microsoft Agent 365), enterprise agent platforms (Agentforce 360), and builder toolkits (AgentKit). Finance/IT teams now need Agent FinOps to keep costs predictable and value‑aligned. See also our vendor‑neutral RFP to compare options: Agent Platform RFP & Scorecard, and our Interop Stack guide and Agentic Support Desk plan.

KPIs you can share with your CFO

- Cost per resolved ticket / per order change

- Auto‑resolve rate and escalation rate

- Cost per 1,000 tokens and per tool call

- Cache hit rate and average steps per task

- Spend vs budget and anomaly count

What’s next

If you already publish a product metrics dashboard, add an “Agent P&L” tab that pairs FOCUS cost with business outcomes and owner. Managers should get weekly emails/slack with variance, causes, and recommended actions. Microsoft has begun publishing cost‑control guidance; expect your platform vendor to follow suit — but keep your telemetry vendor‑agnostic and your allocation model yours. Microsoft Agent cost controls.

Call to action

Want a working Agent FinOps baseline in 30 days? Subscribe for new playbooks, or book a 30‑minute consult — we’ll help you wire up FOCUS + OpenTelemetry and ship your first showback.

Leave a comment